Wind of change: prospects for the Russian market of ventilation and air conditioning systems

The last few years have been difficult for the Russian market of ventilation and air conditioning systems. Since 2020, the market has survived the coronavirus pandemic, the abnormally hot summer of 2021, and now the departure of a number of international manufacturers. At the same time, the Russian market remains promising for working on it.

Air conditioners, industrial fans and refrigeration equipment - the state of the market today:

- Air conditioners

According to the Litvinchuk Marketing agency, about 2.3 million air conditioners were sold in Russia in 2022. This is the third result since 2010, sales were higher only in 2011 and 2021. The reason for this trend is pent-up demand, even despite not the most suitable weather (last year was colder than 2021). The figures for 2023 are likely to be lower - about 2-2.1 million air conditioners. Nevertheless, this will allow Russia to retain the status of the largest market in Europe, outperforming the closest pursuers by more than two times. The dynamics of demand this year also depends on nature: the return of the heat wave of two years ago is likely to lead to an increase in demand for climate systems.

Sanctions had a less significant impact on the Russian market of air conditioners (including VRF). So, in 2021, the share of Chinese air conditioners was about 85%, Japanese - 5%, Korean - 2%. Accordingly, the departure of a number of brands did not greatly affect the Russian market. Moreover, even in the high-budget segment of domestic air conditioners, European and Japanese brands are almost completely replaced by Chinese ones (Haier, Gree, Hisense). However, in some segments (in particular, air conditioners for server rooms) there are positions that have not been replaced yet.

- Industrial fans

At the beginning of 2022, the share of imported industrial fans on the Russian market reached 60%. Basically, these were either European or Chinese products. A year later, this figure remained nearly unchanged, but Chinese manufacturers increased their presence. The main problem of the Russian market of industrial fans is the difficulties with the production of components, including motors. Undoubtedly, some of the European and Japanese components have already been replaced by Chinese counterparts. At the same time, their aerodynamics, geometry and vibration performance are still inferior to European and Japanese parts.

- Refrigeration equipment

In 2021-2022, the volume of imports of refrigeration equipment to Russia, according to the customs service, reached $1.5 billion. At the same time, the share of exclusively imported products was about 20%. The leading position was occupied by China, whose share reached 40% in 2022. Interestingly, about 65-70% of the products on the market related to Russian or international brands were assembled in Russia, however, from imported parts. Increasingly, Russian companies opt for Chinese and Turkish components for refrigeration equipment.

Promising directions of the Russian market of air conditioners

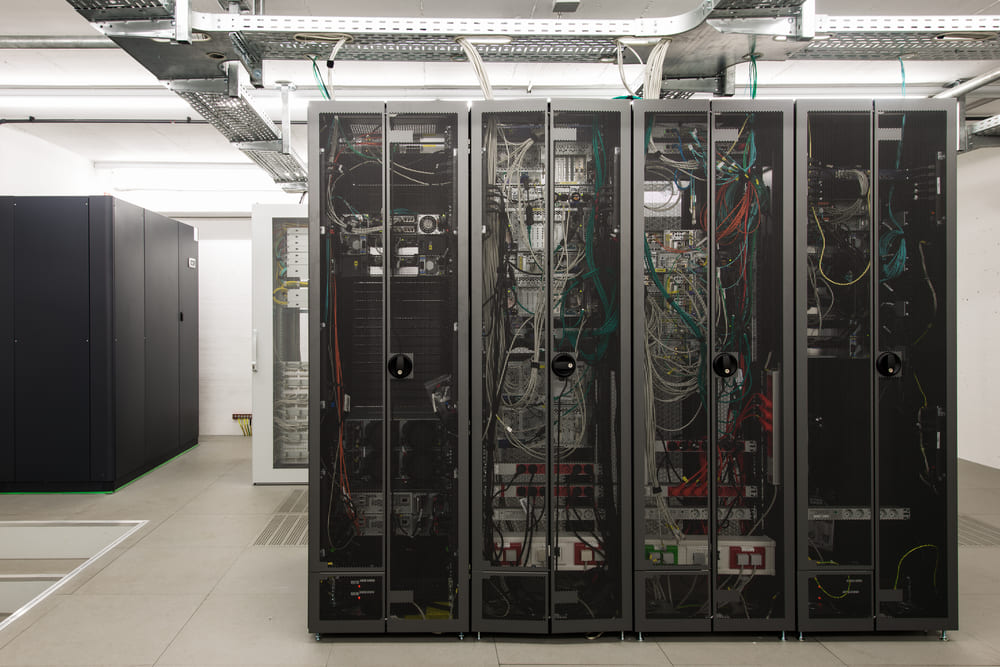

- Air conditioners for server rooms

The share of Japanese manufacturers on the market of non-inventory air conditioners for server rooms in 2020-2021 did not exceed 2%. However, they included systems specially designed for Russia from Japanese manufacturers. They became non-alternative solutions for server rooms, because only Japanese equipment could work 24 hours a day for several years. Some Chinese counterparts have already approached Japanese products in terms of reliability, but the market will in any case positively perceive the release of new air conditioners for server rooms.

- Precision air conditioners

Such systems are most often used in large data centers where high-quality cooling is vital. Until 2022, these air conditioners were produced in Italy and Germany. However, under the current conditions, the supply of products from these countries is difficult. Therefore, there is already a growing interest in precision air conditioners manufactured in other countries. It is worth noting that the leading position in this direction is occupied not by China, but by Turkey. Local manufacturers produce fairly high-quality models that are not inferior to Italian or German ones.

- Available models for home and office

According to experts interviewed by the Kommersant FM radio station, in April-May 2023, models in the price range from 20 to 30 thousand rubles are the most popular. Given the weather forecast for an increase in the average annual temperature in the summer, a further increase in demand for affordable models is likely.

- Premium air filtration and purification systems

One of the most promising segments for new players is premium air filtration and purification systems for apartment buildings, apartment complexes and offices. Until February 2022, developers opted mainly for models from Japanese and European companies. Many manufacturers of such systems have suspended deliveries or left Russia. At the same time, the construction of premium housing in large cities (primarily in Moscow and St. Petersburg) continues, even if with a slight drawdown. By offering developers models comparable in functionality and quality, equipment manufacturers can secure a promising segment for a long time.

A rich exposition of climate control equipment at AIRVent 2024

AIRVent – is an international exhibition of equipment, technologies and services for ventilation, air conditioning and refrigeration of domestic, commercial and industrial facilities. Manufacturers and suppliers of climate control equipment demonstrate products to their target audience there. In 2023, the exhibition was attended by 5,068 visitors from 73 Russian regions and a number of foreign countries. 86% of AIRVent 2023 exhibitors managed to find new clients and business partners.

AIRVent is not only a unique opportunity to communicate with leading industry experts, but also an opportunity to achieve company business goals and find new partners. Participation in the exhibition will allow you to communicate personally with decision makers and reach mutually beneficial agreements that will become the basis for long-term and productive cooperation.